Small and medium-income housing providers are vital in making affordable housing a reality in the USA. Around 5.3 million households in this segment receive federal government rental assistance for affordable housing.

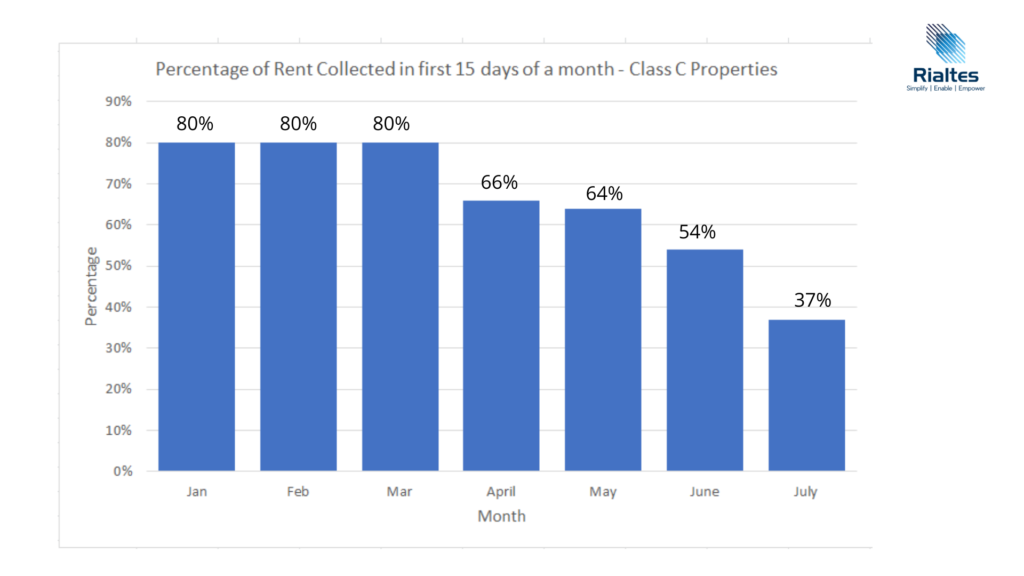

COVID -19 pandemic has had a devastating impact on the renters and the housing providers alike. Since the pandemic started the rental recovery from affordable housing has seen a steady decline. The decline highlights the impact of the pandemic on the USA’s lower and middle-income renters.

There are multiple factors associated with lower rent collection in this period, mainly

- Most of the renters in these affordable housing segment work in areas that were adversely affected by the lockdown and social distancing norms. Many have lost their jobs or are working for lesser hours.

- These segments of renters are the most vulnerable without the aid of federal benefits. These renters have been scrapping through over the past few months on a combination of savings, credit card debt, unemployment benefits and federal stimulus.

- The stimulus or the government benefits might not be enough for the citizens to scrape through the pandemic and the following recession. This means there could be more people staring at eviction or non-availability of jobs.

As the renters are struggling so are the housing providers. Small housing providers stand vulnerable to the domino effect of low rent recovery. This will have a direct impact on the affordable housing segment.

The federal housing assistance programs provide aid to over 5.3 million households in need via Section 8, Public Housing, and USDA rental assistance programs. Small landlords are a significant part of the affordable housing supply but if the rent collection continues to drop, this supply will be severely affected.

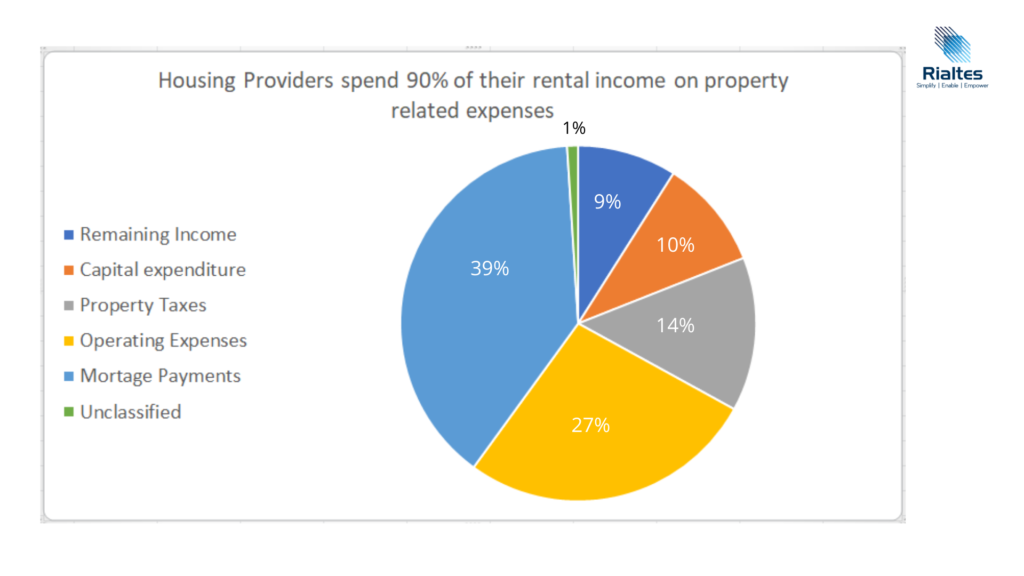

- The small owners are at the biggest risk of mortgage default. Many of the small owners have these housing units as their only source of income. After paying the mortgages, operating expenses, taxes and capital expenditure, they are left with small margins which act as their income source.

- If the rent collection continues to dip, such properties in the affordable segment might go into foreclosure and then might not remain available in affordable markets.

- Shrinking rental income would also mean that the property owner would try and reduce the expenses on repairs and maintenance of the property. This can further deteriorate the building condition in the long term.

- Supply of new homes is tight – affordable or otherwise. In such a scenario with no new inventory coming along sooner, reduction in affordable housing units would lead to increased affordability crises.

- Since the COVID-19 outbreak, the property owners have had to bear additional expenses for the safety of workers and residents. In addition to normal operating expenses (payroll, maintenance, utilities), housing providers are spending money on air filtration, extra cleaning costs, personal protective equipment (PPE), and other health-related expenses to keep properties and personnel safe. If the revenues slip below the break-even point, it might make things difficult for the housing providers of low and medium-income groups to continue.

- Average declines in revenue were greatest for smaller housing providers with fewer than 1,000 units and 1,000 to 5,000 units (12.8% and 12.2%, respectively). This has severely impacted the outlook on investment in future housing projects. 40.6% of affordable housing providers who received assistance have cancelled or postponed their investment plans.

The situation is grim and once the elections are done, it will be important to take some important decisions for the affordable housing sector. Older buildings that have traditionally been a reliable supply of affordable housing, have been short in supply. Market experts suggest, those who can, will take the property off the affordable market for renovations and then return with higher rents, taking them away from the affordable housing segment. It is important to help affordable housing providers recover financially, and restore investment in new affordable housing development to combat the negative impact of the pandemic and achieve better economic recovery.

Source – https://www.ndpanalytics.com/report-covid-housing-providers

Wow! Thank you! I always wanted to write on my website something like that.