Today, real-estate market is one of the most resilient sectors, shrugging off Covid pandemic related impact and achieving greater than normal figures in a short time. The impressive rebound was supported by accommodative fiscal and monetary policy at the national level in USA, lower mortgage rates and better buyer sentiments.

As the housing market is showing seasonal cooling off after fall, it is time to evaluate if the resilience was temporary. Will the housing market stay bullish in 2021? To understand this aspect, we need to understand the current numbers and how they compare to 2019.

According to Lawrence Yun – Chief Economist and Senior VP of Research – NAR (National Association of Realtors) home sales amidst the pandemic were higher than the 2019 numbers by 10.5% and winter months look bright as there are plenty of buyers in the market.

There are a few trends that are going strong and continue to push the housing markets

1. Buyer demand is going strong

In the current buyers’ market, all those who are not shackled by the uncertainties of the job market will likely take the benefits of low mortgage rates. Low mortgage rates, lower taxes as compared to large cities and good returns for investors in the low density sunbelt areas is making this period a good time to invest in real-estate markets. As companies continue to provide work from home options, many families are moving away from dense cities and looking for family homes in lower density suburbs.

2. The inventory is not adding up

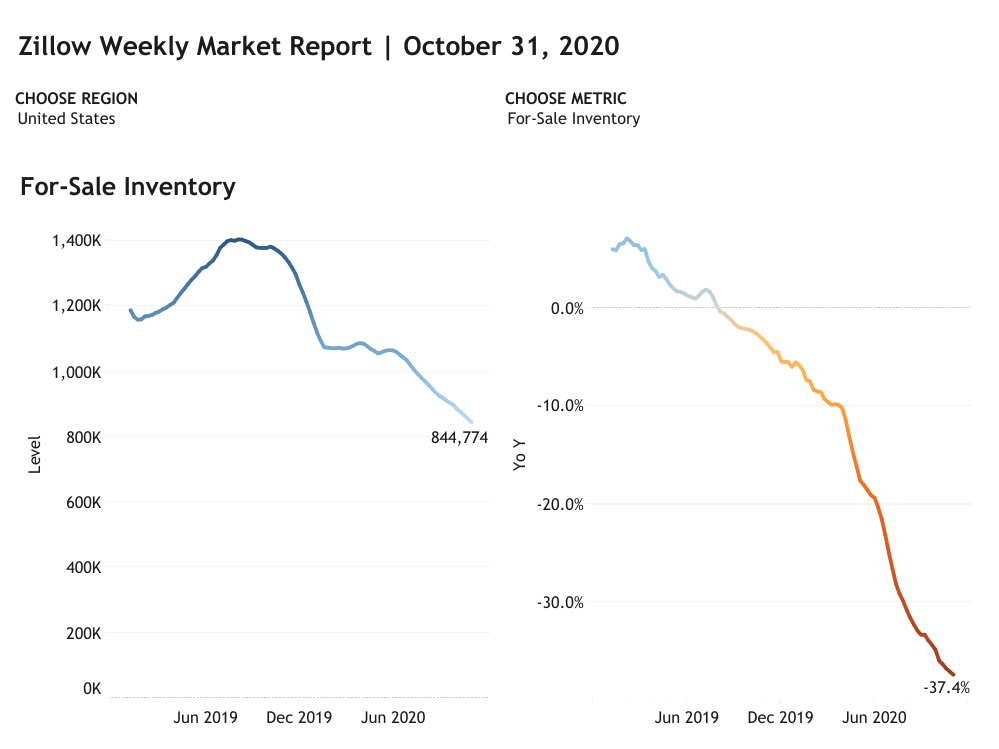

The lack in housing supply continues to fuel the low supply –high demand scenario. The supply situation has grown more acute as the construction activity had come to a standstill. The financing in the construction segment has been sluggish adding to delayed inventory availability. According to latest research by Zillow, new listings dropped by 7.4% (YOY) and the slide in inventory has reached 37.4% lower than at this time last year.

3. Sale prices continue to peak

The housing prices are flattening out and as per the experts it will continue till Jan 2021 and then rise steadily around spring of 2021. As the mortgage rates will continue to be affordable, it will ensure that the buyer sentiments stay high, even if the home prices see an upward trend. To arrest the rising prices, it is essential that new inventory gets added to the market and that will be likely only around first quarter of 2021.

4. Outlook cloudier beyond 2021

In another survey by Pulsenomics and Zillow the economists surveyed were optimistic about the home pricing for 2021 but beyond that the outlook was cloudier. “In contrast to the debate concerning the contours and sustainability of the U.S economic recovery, these survey data reveal a definitive and remarkably sharp V-shape in U.S. home price expectations,” said Terry Loebs, founder of Pulsenomics.

Way forward

While the housing market in most areas is in the positive, the same cannot be said for the whole of the real-estate segment. Research by PWC suggests that while industrial properties, data centers and single-family homes are expected to rise in value, retail and hospitality will see the largest decline.

The market forecast will largely depend on the country’s ability to reign in Covid-19. Only serious home sellers will be in the market as others will prefer to wait out the pandemic related uncertainties before putting their house on the market. The fiscal policies of the government and the rate at which new inventory is added to the market will further fuel the market sentiment and growth.